Tax Brackets How It Works . Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. federal income tax rates and brackets. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. how tax brackets work. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. the income tax bracket in singapore is made up of 10 tax brackets that charge higher taxes for higher incomes, with a cap of 22% withholding tax. how income tax brackets work. You pay tax as a percentage of your income in layers called tax brackets. income is actually divided into different levels, or brackets, that have different tax rates. Each dollar of income is only.

from www.freidelassoc.com

Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. Each dollar of income is only. federal income tax rates and brackets. income is actually divided into different levels, or brackets, that have different tax rates. how tax brackets work. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. how income tax brackets work. the income tax bracket in singapore is made up of 10 tax brackets that charge higher taxes for higher incomes, with a cap of 22% withholding tax. You pay tax as a percentage of your income in layers called tax brackets. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024.

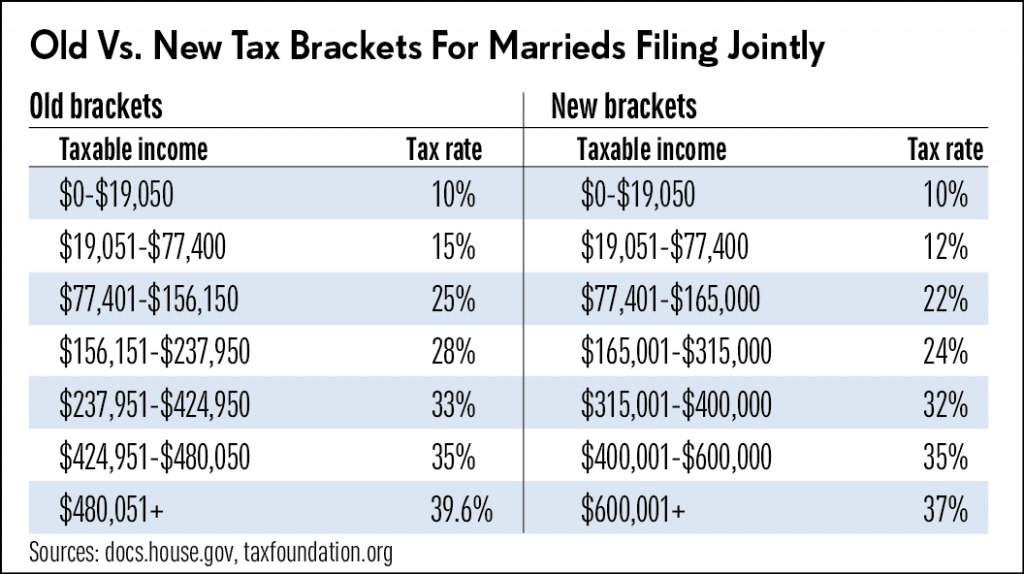

2018 Tax Rates Do You Know Your New Tax Bracket? — Freidel

Tax Brackets How It Works federal income tax rates and brackets. how tax brackets work. income is actually divided into different levels, or brackets, that have different tax rates. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. the income tax bracket in singapore is made up of 10 tax brackets that charge higher taxes for higher incomes, with a cap of 22% withholding tax. Each dollar of income is only. Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. You pay tax as a percentage of your income in layers called tax brackets. how income tax brackets work. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. federal income tax rates and brackets.

From mungfali.com

Tax Brackets 2022 Chart Tax Brackets How It Works Each dollar of income is only. how income tax brackets work. income is actually divided into different levels, or brackets, that have different tax rates. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. You pay tax as a percentage of your income in layers called tax brackets. Web. Tax Brackets How It Works.

From www.financestrategists.com

Tax Brackets Definition, Types, How They Work, 2024 Rates Tax Brackets How It Works Each dollar of income is only. income is actually divided into different levels, or brackets, that have different tax rates. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. how income tax brackets work. Most taxpayers—all except those who fall squarely into only the minimum bracket—have income. Tax Brackets How It Works.

From peavyandassociates.com

Understanding Tax Brackets Peavy and Associates, PC Tax Brackets How It Works income is actually divided into different levels, or brackets, that have different tax rates. federal income tax rates and brackets. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. how tax brackets work. Most taxpayers—all except those who fall squarely into only the minimum bracket—have income. Tax Brackets How It Works.

From www.youtube.com

How Do Tax Brackets Work? YouTube Tax Brackets How It Works If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. how tax brackets work. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. federal income tax rates and brackets. Each dollar of income is only. the income tax. Tax Brackets How It Works.

From www.businessinsider.com

Trump tax plan How tax brackets work Business Insider Tax Brackets How It Works to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. how income tax brackets work.. Tax Brackets How It Works.

From taxrise.com

How Rising Inflation Can Affect Your Federal Tax Bracket Next Year Tax Brackets How It Works income is actually divided into different levels, or brackets, that have different tax rates. federal income tax rates and brackets. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. how income tax brackets work. the income tax bracket in singapore is made up of 10. Tax Brackets How It Works.

From www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know Tax Brackets How It Works Each dollar of income is only. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. how income tax brackets work. federal income tax rates and brackets. how tax brackets work. the income tax bracket in singapore is made up of 10 tax brackets that charge. Tax Brackets How It Works.

From www.planeasy.ca

How Do Tax Brackets Work Simple Example 20000 PlanEasy Tax Brackets How It Works income is actually divided into different levels, or brackets, that have different tax rates. the income tax bracket in singapore is made up of 10 tax brackets that charge higher taxes for higher incomes, with a cap of 22% withholding tax. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect. Tax Brackets How It Works.

From www.actblogs.com

Everything You Need To Know About How Tax Brackets Work Tax Brackets How It Works Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. how tax brackets work. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. income is actually divided into different levels, or brackets, that have different tax rates. to achieve greater progressivity, the. Tax Brackets How It Works.

From bellqcelestyna.pages.dev

Current Us Tax Brackets 2024 Renie Delcine Tax Brackets How It Works If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. You pay tax as a percentage of your income in layers called tax brackets. how income tax brackets work. federal income tax rates and. Tax Brackets How It Works.

From andrewsandcompany.net

Tax filers can keep more money in 2023 as IRS shifts brackets Andrews Tax Brackets How It Works the income tax bracket in singapore is made up of 10 tax brackets that charge higher taxes for higher incomes, with a cap of 22% withholding tax. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. how tax brackets work. You pay tax as a percentage of. Tax Brackets How It Works.

From www.financestrategists.com

Taxes Ultimate Guide Tax Brackets, How to File and How to Save Tax Brackets How It Works income is actually divided into different levels, or brackets, that have different tax rates. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. Each dollar of income is only. You pay tax as a percentage of your income in layers called tax brackets. how income tax brackets work. Web. Tax Brackets How It Works.

From mehndidesign.zohal.cc

How Do Federal Tax Brackets Work ZOHAL Tax Brackets How It Works You pay tax as a percentage of your income in layers called tax brackets. federal income tax rates and brackets. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. Web. Tax Brackets How It Works.

From www.articleinsider.com

Finance Terms Tax Brackets Article Insider Tax Brackets How It Works Each dollar of income is only. income is actually divided into different levels, or brackets, that have different tax rates. You pay tax as a percentage of your income in layers called tax brackets. how tax brackets work. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. the. Tax Brackets How It Works.

From topdollarinvestor.com

2023 Tax Rates & Federal Tax Brackets Top Dollar Tax Brackets How It Works federal income tax rates and brackets. You pay tax as a percentage of your income in layers called tax brackets. income is actually divided into different levels, or brackets, that have different tax rates. If your marginal tax rate is 24%, that doesn’t mean you’ll lose 24% of your income to taxes. how tax brackets work. Each. Tax Brackets How It Works.

From www.wallstreetmojo.com

Tax Bracket Meaning, Explained, Examples, Vs Effective Tax Rate Tax Brackets How It Works the income tax bracket in singapore is made up of 10 tax brackets that charge higher taxes for higher incomes, with a cap of 22% withholding tax. income is actually divided into different levels, or brackets, that have different tax rates. Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. You. Tax Brackets How It Works.

From www.schwab.com

How Do Tax Brackets Actually Work? Charles Schwab Tax Brackets How It Works Each dollar of income is only. Most taxpayers—all except those who fall squarely into only the minimum bracket—have income that is taxed. to achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. You pay tax as a percentage of your income in layers called tax brackets. how tax brackets. Tax Brackets How It Works.

From www.theadvertiser.com

How tax brackets affect what you pay in taxes Tax Brackets How It Works income is actually divided into different levels, or brackets, that have different tax rates. the income tax bracket in singapore is made up of 10 tax brackets that charge higher taxes for higher incomes, with a cap of 22% withholding tax. You pay tax as a percentage of your income in layers called tax brackets. If your marginal. Tax Brackets How It Works.